As connoisseurs of credit cards that promise luxury and exclusivity, we find the UOB Visa Infinite Metal Card commanding attention in Singapore’s competitive premium card market. Boasting an eye-catching metal design, the UOB Visa Infinite Metal Card caters to discerning clients with a penchant for travel, dining, and comprehensive perks. The card’s recent updates have potentially transformed it from an underperformer, as once perceived, to a valuable asset in a high-net-worth individual’s wallet.

Unpacking the UOB Visa Infinite Metal Card reveals a compelling reward system. New cardholders are greeted with a substantial welcome offer of air miles, which, coupled with category-specific rewards, aim to enhance shopping and travel experiences. Perks including access to exclusive lounges and gourmet dining deals outline UOB’s commitment to fulfilling lifestyle aspirations, while advanced security features underline the institution’s focus on client safety. The card’s recognition in Singapore stems from a blend of luxury benefits and practical day-to-day uses.

Key Takeaways

- The attraction of UOB Visa Infinite Metal Card lies in its combination of style and substance with a strong emphasis on travel and lifestyle perks.

- The reward system is designed to cater efficiently to high spenders, offering a substantial air miles program and exclusive dining privileges.

- Security measures and customer service form the backbone of this premium offering, enhancing its appeal in comparison to similar cards.

Card Overview

In this section, we will cover the UOB Visa Infinite Metal Card’s key aspects such as eligibility, fees, and its distinct metal design. These details are essential in understanding the value proposition of the card.

Eligibility Requirements

To apply for the UOB Visa Infinite Metal Card, applicants must meet the following criteria:

- A minimum annual income of S$120,000 is required.

- The card is targeted towards high earners looking for premium credit card features.

Annual Fees

- Primary Card: The annual fee for the UOB Visa Infinite Metal Card is S$642 (inclusive of GST).

- Supplementary Card: Fees may apply for additional cardholders.

- Air Miles Rewards: The card offers up to 40,000 air miles as part of the membership benefits—25,000 miles upon joining or renewal, and an additional 15,000 miles upon a minimum spend of S$100,000 in a membership year.

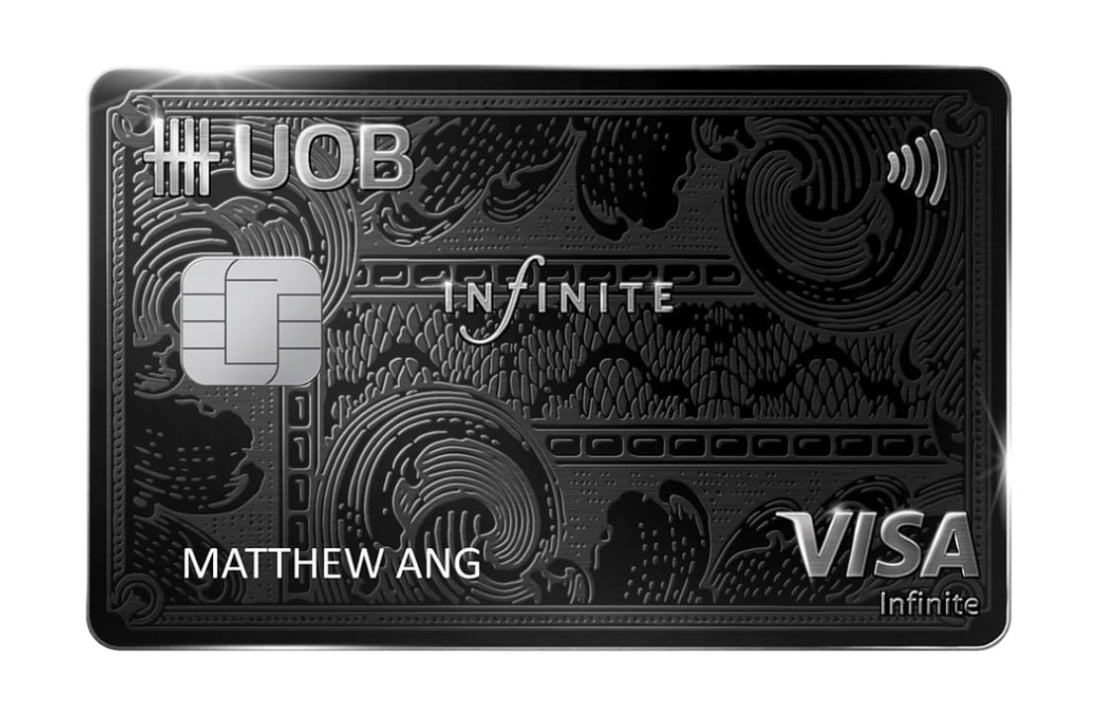

Metal Card Design

- Material: The card features a sleek, metal design that distinguishes it as a premium product.

- Aesthetics: Emphasizing exclusivity, the card has a sophisticated appearance, reflecting the status of its cardholders.

Reward System

The UOB Visa Infinite Metal Card offers a comprehensive reward system designed for the discerning spender. We’ll explore the earn rate, redemption options, and exclusive benefits that make this card stand out.

Earn Rate

The earn rates for the UOB Visa Infinite Metal Card are competitive. Members can accrue rewards through the following means:

- Local Spend: Earn 1.4 miles per S$1 spent locally.

- Overseas Spend: Receive 2 miles per S$1 spent overseas.

Redemption Options

Cardholders have various redemption options for accumulated miles which include:

- Flight Bookings: Miles can be used to book flights across multiple airlines.

- Hotel Stays: Redeem miles for hotel accommodations worldwide.

- Lifestyle Rewards: Use miles for experiences and exclusive items.

Exclusive Benefits

The UOB Visa Infinite Metal Card also comes with an array of exclusive benefits:

- Airport Lounge Access: Complimentary access to VIP airport lounges.

- Concierge Services: 24/7 concierge service to assist card members.

- Dining Privileges: Up to 50% off at selected dining establishments.

Travel Features

When discussing the UOB Visa Infinite Metal Card, it’s essential to outline the array of travel features offered. Two standout benefits in this category are Airport Lounge Access and Travel Insurance – offerings that frequent travellers often prioritize.

Airport Lounge Access

- DragonPass Membership: Cardholders are entitled to unlimited lounge visits.

- Complimentary Guest Access: Accompanying guests can also enjoy lounge access, enhancing the overall travel experience.

Travel Insurance

- Comprehensive Coverage: The UOB Visa Infinite Metal Card provides robust travel insurance for peace of mind.

- Variety of Protections: Coverage extends to travel accidents, travel inconveniences such as baggage delays, and more.

Dining Privileges

Our UOB Visa Infinite Metal Card offers a suite of dining privileges that enrich the culinary experiences of our cardholders. From fine dining access to exclusive discounts, we ensure our customers savor the best for less.

Fine Dining Access

We offer our cardholders the opportunity to indulge in fine dining experiences at select restaurants. With the UOB Visa Infinite Metal Card, access to exquisite and high-end culinary delights is at your fingertips, reinforcing our commitment to providing premium privileges.

Dining Discounts

- Weekday Discounts: Cardholders enjoy a 50% discount for dine-in on weekdays at participating restaurants, subject to one card per table and a maximum of two persons per bill.

- Group Dining: For larger gatherings, we offer discounts for groups up to 15 persons per bill, ensuring that the joy of dining is better shared.

Please note that privileges are subject to the terms and conditions applicable at the time of dining.

Additional Perks

In our exploration of the UOB Visa Infinite Metal Card, we’ve identified an array of additional perks that cater to our sophisticated lifestyle and leisure preferences. Among these, concierge services and golfing privileges stand out, offering convenience and exclusive access to premium experiences.

Concierge Service

The UOB Visa Infinite Metal Card offers us a dedicated concierge service designed to assist with our various personal requests. Whether it’s booking reservations at top-tier restaurants or sourcing tickets for sought-after events, the concierge is there to facilitate these arrangements on our behalf. This service exemplifies the card’s commitment to providing a seamless and personalized experience for all cardholders.

Golfing Privileges

For those of us who enjoy golf, the UOB Visa Infinite Metal Card grants access to some of the most prestigious golf clubs locally and worldwide. We can take advantage of complimentary green fees, preferential booking status, and special golfing events that are exclusive to cardholders. These privileges enable us to indulge in our passion for the sport while experiencing the luxury and convenience that come with the card.

Security Elements

When discussing the UOB Visa Infinite Metal Card, we prioritize the importance of security features designed to protect our cardmembers. Two critical components include fraud protection and the convenience of contactless payments.

Fraud Protection

We implement multiple layers of fraud protection to ensure the security of every transaction. This involves continuous monitoring for unusual activity and instant alerts to cardmembers for potential fraud. Our system is designed to detect and react promptly, safeguarding our cardmembers’ financial interests.

Contactless Payments

Our card supports contactless payments, offering both security and convenience. These transactions use secure encryption, which significantly reduces the risk of skimming or unauthorized data retrieval. Just tap the card on the reader for a quick and secure checkout.

Customer Feedback

In evaluating the UOB Visa Infinite Metal Card, we’ve gathered insights from actual users and experts in the field to offer a comprehensive view based on experiences and professional analysis.

User Testimonials

-

Satisfaction with Rewards:

- Users often mention the 80,000 air miles for new customers as an impressive sign-up perk.

- Repeat customers value the 40,000 reward miles when they stay loyal to the card.

-

Comments on Costs:

- The annual fee of S$654 is a common point of discussion, with some users noting it as a significant cost for the card’s benefits.

Expert Reviews

-

Analysis of Benefits Versus Cost:

- The UOB Visa Infinite Metal Card’s benefits are acknowledged, but experts like The MileLion have pointed out that it used to be overpriced when compared to its offerings. However, recent reviews suggest a turnaround in the perceived value.

-

Comparative Value:

- Compared to other cards in the market, professionals from SingSaver note the cost per mile at 2.61 cents positions the card competitively, albeit not the cheapest option available.

Comparative Analysis

In assessing the UOB Visa Infinite Metal Card, we consider its standing against its peers and its unique place in the Singaporean market.

Competitor Comparison

When evaluating the UOB Visa Infinite Metal Card, it is essential to compare it directly with other premium metal credit cards available to consumers in Singapore. Here are some key points of comparison:

- Annual Fees: We find that, like other premium cards, the UOB visa Infinite Metal Card commands a high annual fee. Compared to others in its category, the fee is competitive and aligns with the industry’s standards for luxury cards.

- Earning Requirements: The card stipulates a minimum earning requirement that might surpass some of its competitors, reflecting its targeting towards an affluent clientele.

- Exclusive Perks: The card offers a suite of benefits including unlimited airport lounge access, air miles, and dining privileges. These perks are comparable to the best offerings in the segment.

*It is crucial to note that specific features and benefits can be subject to change, and consumers should verify current terms.

Market Positioning

The UOB Visa Infinite Metal Card occupies a distinct niche in the Singaporean credit card market:

- In terms of Status: Its metal design and premium benefits package position it as a status symbol within the local market.

- Regarding Rewards and Benefits: The card provides a competitive rewards structure, particularly in relation to travel and dining, positioning it favorably for consumers valuing these luxuries.

- Accessibility: This card distinguishes itself from cards available only through invitation by being accessible through direct application, increasing its appeal to qualified applicants seeking immediate luxury card access.